Overview

Payments initiation using Open Banking Protocol

Payment initiation is a type of payment method facilitated by open banking. Put simply, it involves customers allowing third-parties to connect to their banks and authorize payments directly from their bank account

In order to get started with payments, you first need to make sure the customer, with the same userId has an ACTIVE connection. See Create Connection

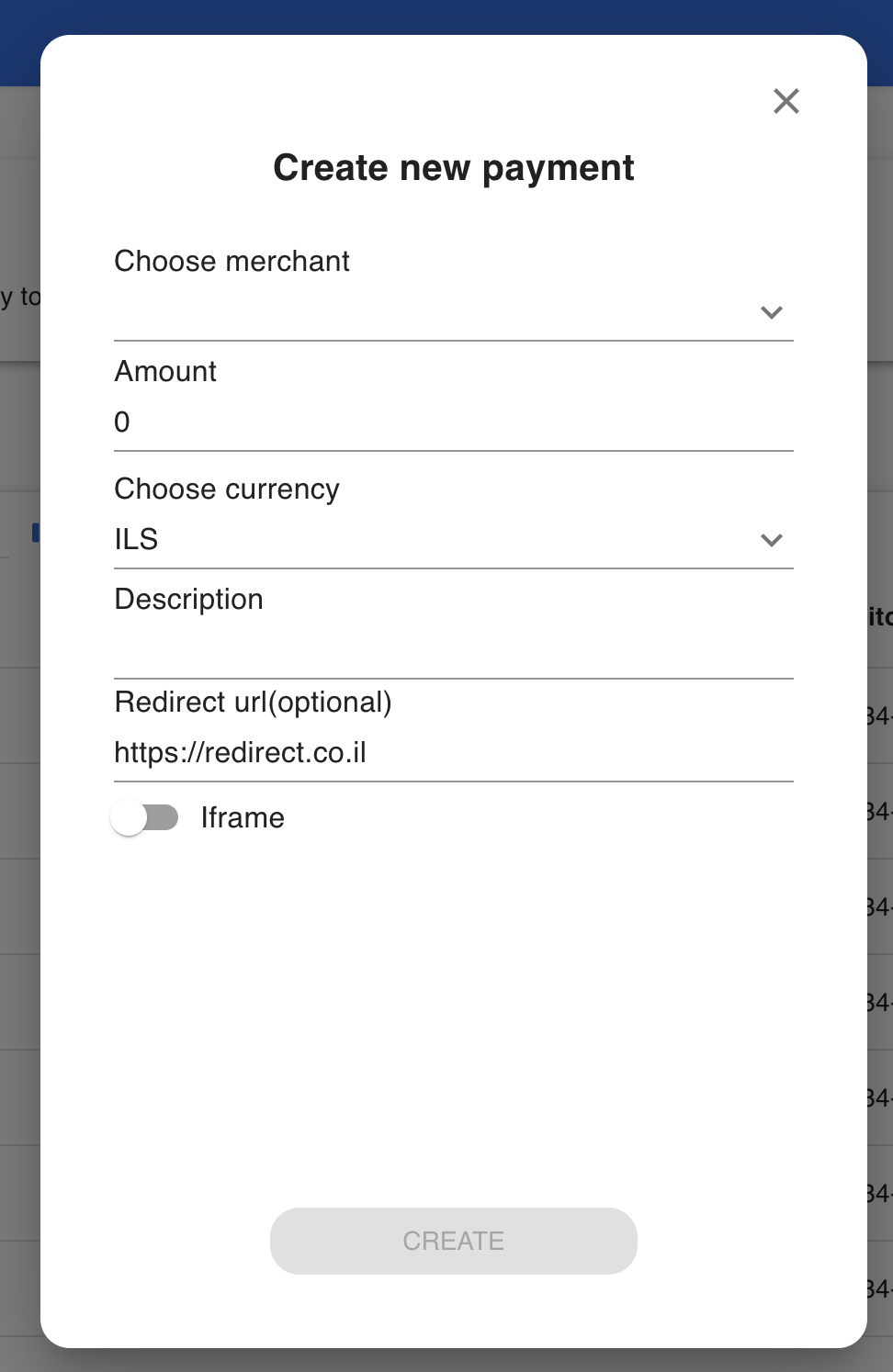

The payment initiation starts with creating a payment for the user using the Create Pay request.

Request Parameters

Payment Products

For payment product, only the payments is supported at this moment.

Payment Services

For payment service:

| Payment service | Description |

|---|---|

| masav | The default payment service, all transfers under 1M Shekels. Please keep in mind that some banks use masav as their fast payment method. |

| zahav | Zahav transfer service, for fast payments and payments above 1M shekels. Please keep in mind the fees using zahav payment service. |

| fp | Faster Payment. Use this service when transferring money in the same bank (same providerId), and when wanting to transfer using the Faster Payment system. |

PSU ID Types

Each provider has different PSU ID types. The PSU ID type is the channel where the PSU (Payment Service User) is going to log in from. In some cases it's the differentiation between business or personal accounts and in other cases it's sub-banks under a bank group.

| ProviderId | Psu id types | Description |

|---|---|---|

| leumi | leumi | |

| pepper | pepper | |

| discount | Retail, SME | Retail for personal accounts, SME for business accounts |

| mercantile | Retail, SME | Retail for personal accounts, SME for business accounts |

| hapoalim | privateBankCustomers, businessBankCustomers | privateBankCustomers for personal accounts, businessBankCustomers for business accounts |

| mizrahi | Leave empty | |

| beinleumi | FIBI-BNL, FIBI-OTZAR, FIBI-UBANK, FIBI-PAGI, MASSAD | FIBI-BNL for Beinleumi bank, FIBI-OTZAR for Otzar Hahayal bank, MASSAD for massad bank |

| yahav | Leave empty |

Account Types

In the paymentInformation object you need to specify the debtor and creditor accounts type and number.

| Account Type | Description | Account Number Example |

|---|---|---|

| bban | Local bank account number in the following format - XX-XXX-XXXXX | 10-944-50151141 |

| 1 - Bank Identifier - 2 digits | ||

| 2 - Branch Number - 3 digits | ||

| 3 - Bank Account Number - Dynamic | ||

| iban | International bank account number. | IL730100040000000552711 |

| 1 – Country Code – 2 letters | ||

| 2 – Check Digits – 2 digits | ||

| 3 – Bank Code – 4 digits | ||

| 4 – Bank Branch – 4 digits | ||

| 5 – National Code – 2 digits | ||

| 6 – Bank Account Number – 10 digits. |

Supported Payment Services and Account Types

The payment service and account types are different on every provider.

The following table maps the provider to the supported payment service and account types

Please notice that fp payment service must be used when doing payment initiation with the same provider as debtor and creditor

| Provider Id | Payment Service | Account Types | Notes |

|---|---|---|---|

| leumi | masav | bban | masav is used in Leumi to conduct Faster Payment too. |

| pepper | masav | bban | masav is used in Pepper to conduct Faster Payment too. |

| discount | masav + fp | iban | |

| mercantile | masav + fp | iban | |

| hapoalim | masav | bban | |

| mizrahi | masav + fp | iban | |

| beinleumi | masav | iban | |

| yahav | masav | iban |

Redirect url

When creating a new payment you have an option to add a redirect link. This will be the link that the user will be redirected to when they finish the payment journey. To this link we always add paymentId, userId and paymentStatus as query params.

Redirect url for example(after adding to it the query params): https://www.redirect.co.il?userId=user123&paymentId=1Hi83jf8cni8i&paymentStatus=ACTC

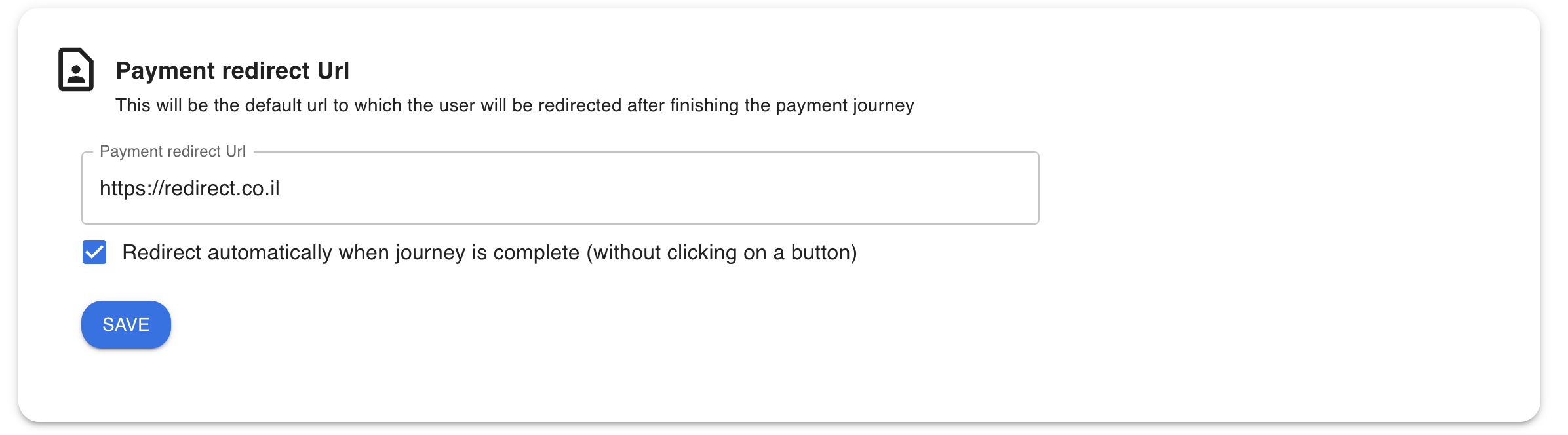

If you have always the same link that you want users to be redirected to you can define it in the organization settings under "Payment redirect Url". Here you can also choose whether you want the user to be automatically redirected when the journey is finished or if you want him to see the "Payment success" screen and only when pressing the redirect button the user will be redirected.

Response

Authorization URL

In the response you will get a url in the scaOAuth parameter. You will need to refer the customer to this url in order for him to log in to his bank account and authorize the payment.

Payment Statuses

The payment status indicates the payment transfers status.

Please see the following Payment Status Page

Testing with sandbox accounts

Each account will return different statuses for testing purposes

Testing with Sandbox Accounts

Each account will return different statuses for testing purposes.

| Account IBAN | Account BBAN | Result Status | Additional Info |

|---|---|---|---|

| IL060311140000000436003 | 31-114-436003 | ACSC | |

| IL500311140000000436666 | 31-114-436666 | ACSP | |

| IL060311140000000436682 | 31-114-436682 | CANC | |

| IL380311140000000436688 | 31-114-436688 | ACFC | |

| IL060311140000000436488 | 31-114-436488 | PATC | After completing the payment it will change to ACTC to simulate multiple authenticators account |

| IL410311140000000436440 | 31-114-436440 | PART | |

| IL120311140000000436283 | 31-114-436283 | PENDING | |

| IL190311140000000436254 | 31-114-436254 | ACCC | |

| IL070311140000000435694 | 31-114-435694 | ACTC | |

| IL630310640000000406821 | 31-064-406821 | ACWC | |

| IL490311240000000272604 | 31-124-272604 | RJCT |

Get Live Payment Status

In order to get the live payment status, you need to make a request to Get Payment Status using the paymentId given in the response.

Updated 7 months ago